From automating calculations to supporting local compliance forms and registration processes, our solution is designed to simplify your operations and eliminate risks.

Unify Processes

Simplify Compliance

Empower Your Team

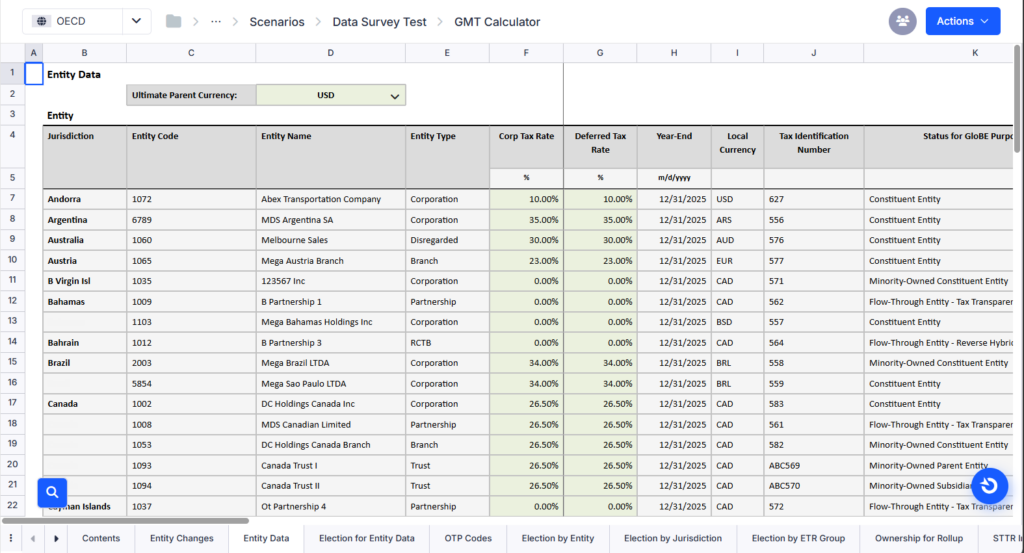

Extra Large companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

Medium companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

Large companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

Smaller companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

| Feature | Benefit |

|---|---|

| Local Compliance Forms | Simplify filing requirements across jurisdictions |

| Local Registration Support | Ensure smooth registration in new jurisdictions |

| Automated Tax Calculations | Minimize errors and save time |

| Daily Legislative Updates | Stay ahead of global and local tax changes |

| Integration with ERP Systems | Maximize efficiency across existing workflows |

| Custom Dashboards | Gain insights and visualize compliance data |

| Cloud-Based Architecture | Secure and scalable, accessible anywhere |

Unify Processes

Simplify Compliance

Empower Your Team