Over the last years technology has advanced to unprecedented levels. With such change there has been reform in all industries. The tax world is no different.

Recent surveys have found that 73% of executives in tax departments expect to see changes in government tax requirements in the next 2 years. Such studies also found that tax professionals are now recognizing they don’t have access to the right tools to do their jobs properly (Thomson Reuters Institute, 2022).

Moreover, the report mentions that 61% of tax professionals have been at their current company for less than 10 years and employee turnover rates are significantly higher than previous years due to retirement, lack of career progression or other reasons.

In the current highly evolving corporate and regulatory climate, tax departments find it difficult to develop talent due to shorter employee tenures, and employees find it challenging to keep up with all the changes. Now, more than ever, technology can help provide employees with the tools to streamline their jobs and reduce dependency in case anyone leaves the company. With the adoption of the right technology, companies can ensure that their tax departments run smoothly.

Introducing the Orbitax Executable Actions Tool (E.A.T.)

The Executable Actions Tool (E.A.T.) lets you create, share and even execute tax workflows based on conditional steps and actions. When an individual stakeholder needs to complete a task, they simply follow a checklist shared with them through email and without the need to log into a system. This makes E.A.T. one of the most versatile and productivity enhancing tools on the market.

E.A.T. complements all Orbitax solutions but can also be used stand-alone.

E.A.T., Sleep, Report, Repeat – a real-life example

When talking to clients we have found that large companies with numerous entities in different jurisdictions find it extremely difficult and time consuming to keep track of all their various due dates for different filings. To put this into perspective: if a company operating at an international level were to track and manage their due dates manually, this proves to be a huge undertaking in terms of time, dedicated professionals and resources. A tax manager might have to send multiple emails to all their controllers in different countries to get an update on the due dates and the progress of filing returns. Moreover, the due dates and their filing progress are most likely to be tracked using a spreadsheet manually. From our observation, the whole process of sending multiple emails, waiting for their reply, getting the relevant files and storing them along with consolidating all the information in one place could take weeks to complete with dedicated personnel to manage all these. Furthermore, overdue filings give rise to another dimension of complications where an error may result in hefty fines.

The Orbitax Due Date Tracker provides an automated tracker that tracks all of your due dates in one place along with documentation features to work collaboratively on the filings. With our Due Date Tracker you get access to a library with detailed information about all the Due Dates for each country along with Orbitax Drive, which allows you to store all the relevant documents in one convenient location. Our solution supports a wide range of Global, US State and Other filings (e.g. CIT, VAT, CBC, TP and more!). Moreover, our Executable Actions Tool (E.A.T.) has default workflows for various filing types where it is as simple as just assigning the relevant people to specific tasks and letting our tool automate the notification, collection and tracking processes. Once a workflow is launched, the next person to work on the filing will automatically get notified for the filing to move smoothly in a streamlined process. We can proudly say that with our E.A.T. solution you can effectively reduce lead times for some of your due date tracking tasks by weeks! Moreover, it can also improve your departmental cohesiveness with our collaborative features.

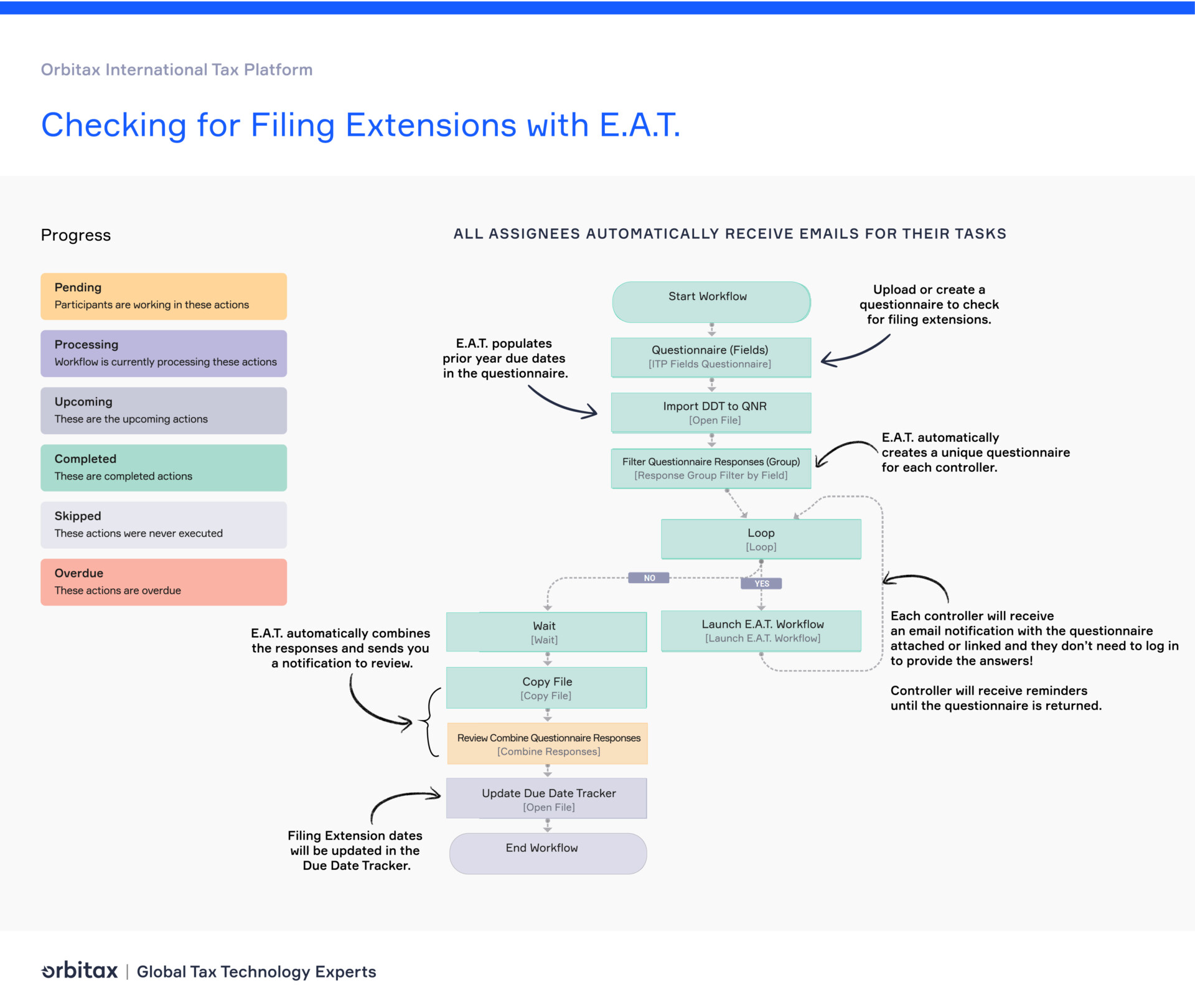

A common example is updating due dates with filing extensions. You can easily do that with E.A.T. and incorporate that custom information into your Due Dates Grid! Once you configure the workflow with your specifications and start the workflow, E.A.T. will automatically create a questionnaire based on the extension information requested, import the prior year due dates to that questionnaire and filters the questionnaire to create separate files for all the local controllers. It will then send an email to all of them and they can simply download the questionnaire (Excel format), add the extended filing date (if applicable) and reply back to the email; the information from all the controllers will then be consolidated and ready for you to review. Once you sign off, the deadlines will be updated in your Due Dates Grid automatically! Apart from setting up the workflow, launching it and reviewing the responses, you don’t need to do anything more; E.A.T. will take care of the rest. No more emailing every single person, sorting and consolidating the data, and updating it all manually; you can just E.A.T., Sleep, Report and Repeat!