International Tax Platform / Tax Research & Compliance

The world’s most complete array of cross-border tax analysis and data

Global Head of Sales & Partnerships

Unify: Access over 41,000 law change reports, 32,000 tax articles, and 195+ country analyses.

Simplify:Automate the compliance process with easy-to-use tools and workflows.

Empower: Gain confidence with insights powered by 4,000+ tax treaties and 2,200 tax forms across VAT, CIT, TP, and WHT.

Extra Large companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

Medium companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

Large companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

Smaller companies without a large foreign imprint might be able to keep everything in Excel, but for a company with a large amount of CFCs or foreign branches and any other type of foreign entities, using the International Tax Calculator would make their lives so much easier.

| Key Feature | Benefit |

|---|---|

| 41,000+ Law Change Reports | Stay compliant with every global tax update. |

| 32,000+ Tax News & Articles | Gain critical insights into global tax trends. |

| 4,000+ Tax Treaties | Navigate international tax agreements confidently. |

| 2,200+ Tax Forms (VAT, CIT, TP, WHT) | Simplify multi-jurisdictional compliance. |

| 160+ Daily Updated FX Rates | Ensure accurate currency calculations. |

| 195+ Country Analysis | Access in-depth tax data for comprehensive planning. |

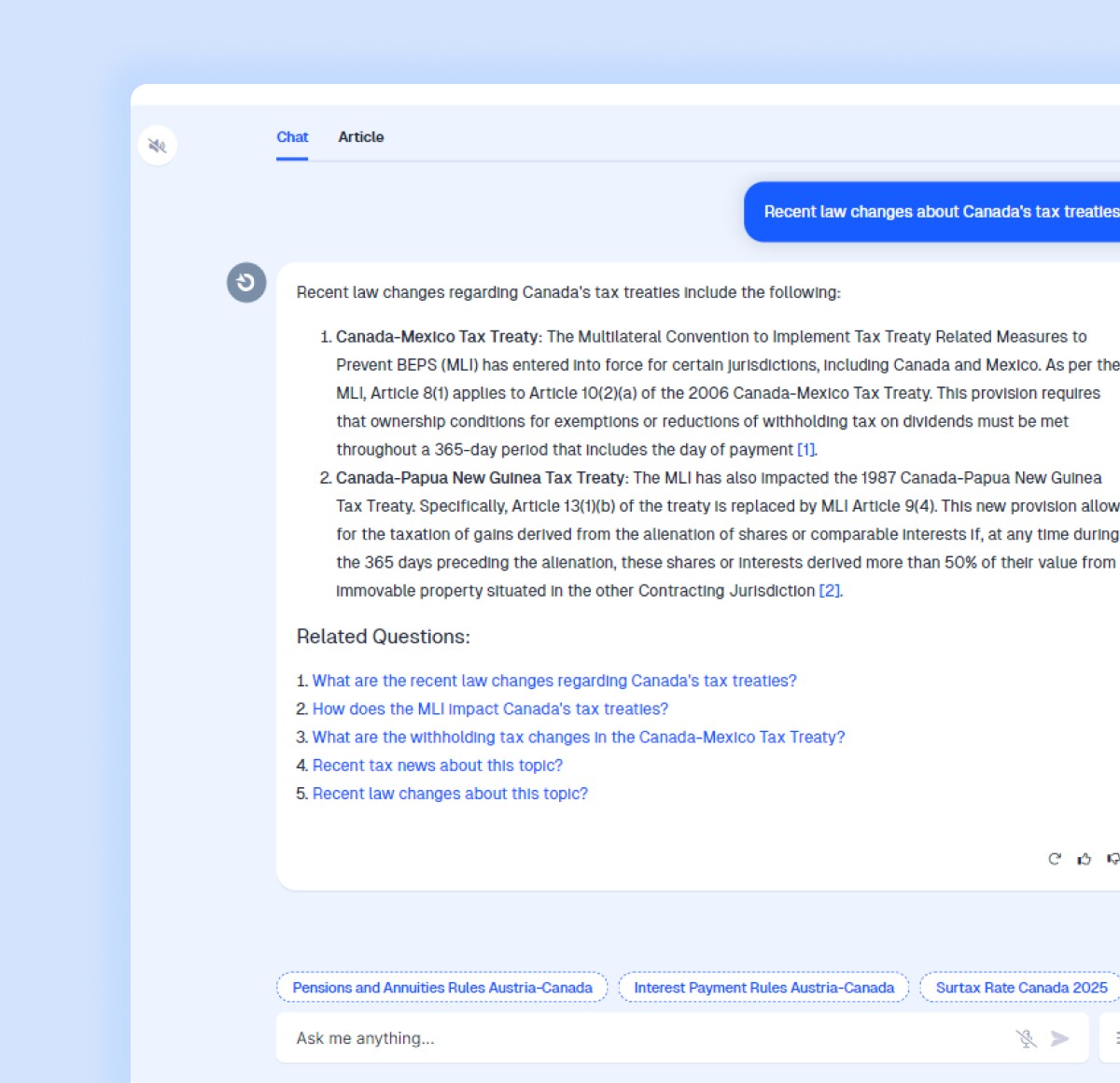

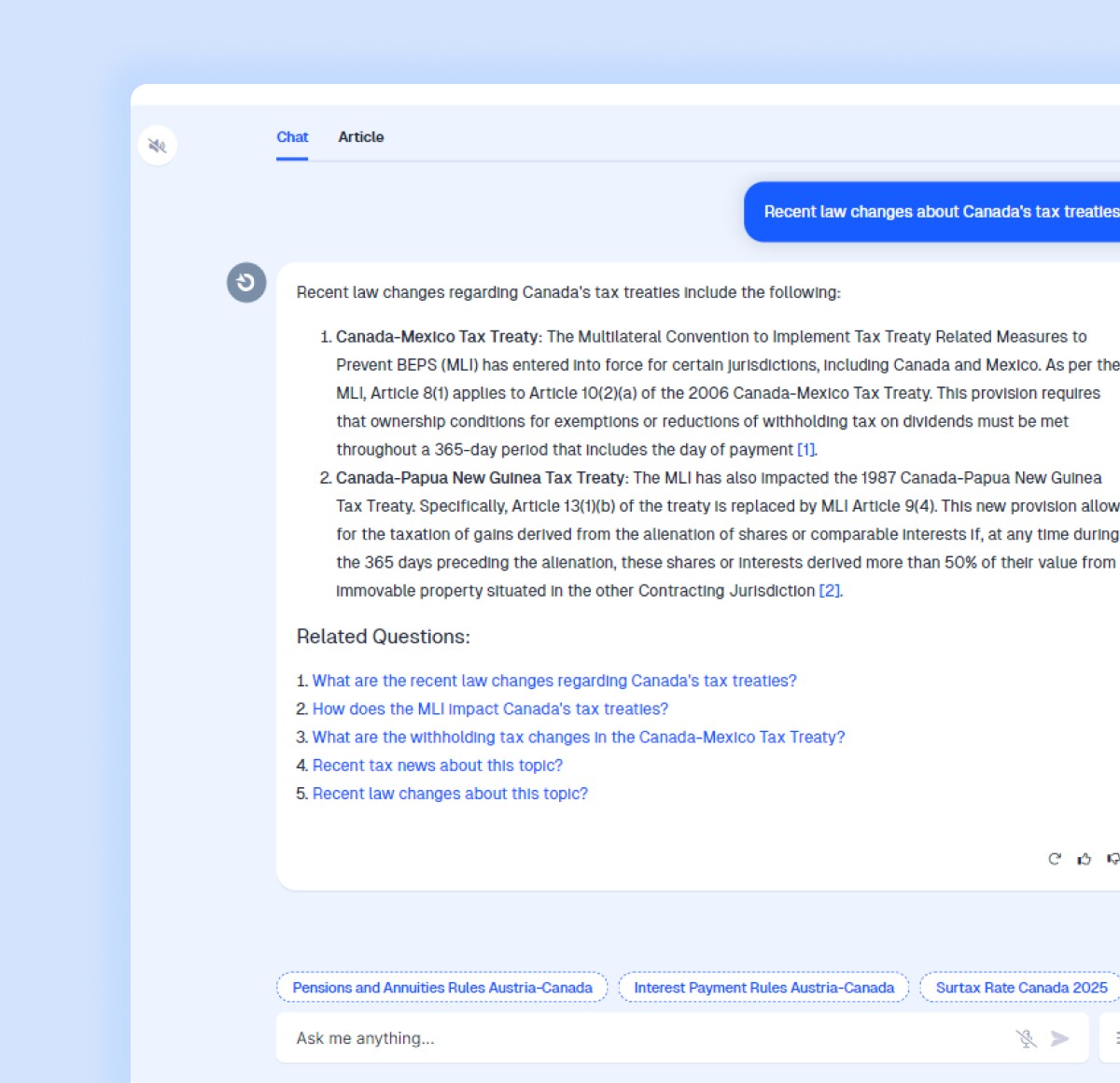

| AI-Powered Research Assistant | Get precise, actionable answers faster. |

| Automated Compliance Workflows | Save time and minimize errors. |

| Integration with ERP Systems | Streamline data sharing across platforms. |

| Customizable Dashboards | Visualize insights that matter most to you. |