International Tax Platform / GMT (Global Minimum Tax)

Get ready for Pillar Two: Assess, Connect, Calculate, Comply, and Plan

Global Head of Sales & Partnerships

Perform a high-level Safe Harbour Eligibility Assessment to identify jurisdictions that could be exempt under the transitional safe harbour rules and the top-up tax payable by jurisdictions that do not meet the exemption.

Receive a Readiness Report with all the data points required to perform a full Pillar Two calculation for entities that do not qualify for the Safe Harbour.

All this with just your CbC Report XML or latest US Tax Return XML.

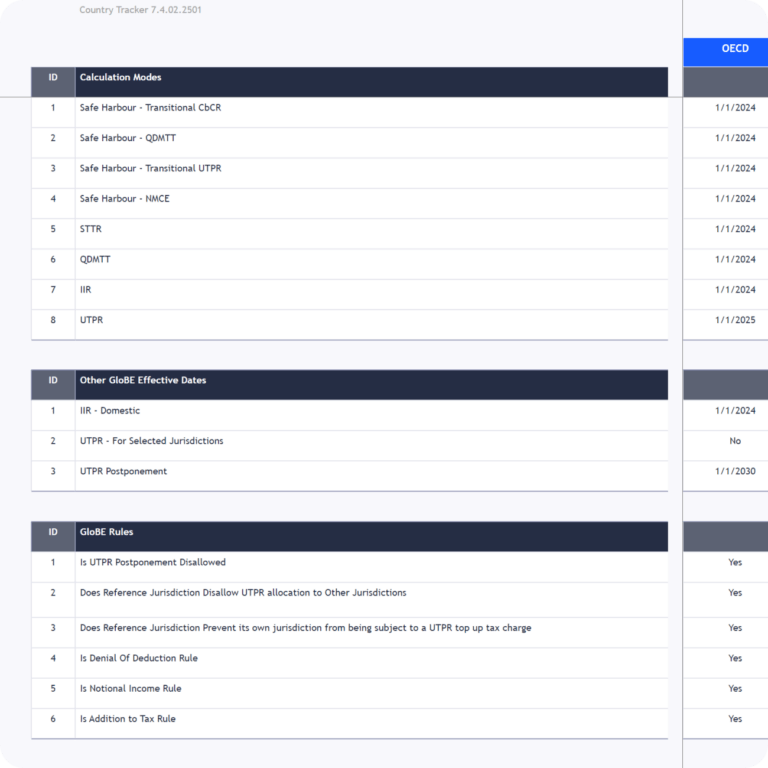

Calculations, reporting, compliance, and planning for Global Minimum Tax, Country-by-Country (CbC) Reporting, and US International Outbound Tax (incl. GILTI, BEAT, FDII, Subpart F, Foreign Dividends, and US FTC) are powered by the Orbitax Global Tax Calculator (GTC). GTC is fully integrated on the Orbitax ITP, combining an extensive, trusted tax law database of 190+ countries with powerful calculation, reporting, and workflow tools.

Example: Country-by-Country reports (CbCr) are completed in the Orbitax CbC Compliance & Reporting solution as part of the Orbitax GTC and can be used to determine the Pillar Two safe harbor exemptions. Qualified Domestic Minimum Top Up Taxes (QDMTT) calculated in the GMT solution are used as a FTC inside the Orbitax ITC when calculating US Subpart F and GILTI which are in turn used by the Orbitax GMT solution when calculating jurisdictional top up taxes for the income inclusion rule (IIR) and the undertaxed profit rule (UTPR) calculations.

Once the calculations are completed, Orbitax Global Minimum Tax automatically populates reports for the tax provision, the GloBE Information Return (GIR), and any other local compliance forms.

The out-of-the-box connector to ONESOURCE Tax Provision (OTP) pushes the STTR, QDMTT, IIR and UTPR to OTP.

Returns and forms can be transmitted directly to the tax authorities, where possible. The Orbitax GMT software leverages the functionality of the Orbitax Due Date Tracker to track worldwide Pillar Two due dates, with one screen to monitor submissions made, accepted / rejected, and resubmissions.

The Orbitax Pillar Two software allows you to complete multi-year forecast calculations by expanding your base year input with growth assumptions and other input changes.

Planning calculations can reflect what-if scenarios, law changes, and other global minimum tax impacts.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum rhoncus justo sapien, imperdiet dictum lectus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed dictum tincidunt neque, tempus porta turpis porta eu. Nam ut ex condimentum, aliquet nulla sed, tincidunt diam.

An Order of the General Court of the EU has been published regarding an action (Case T-144/23) brought by Fugro NV, established in Leidsche An Order of the General Court of the EU has been published regarding an action (Case T-144/23) brought by Fugro NV, established in LeidscheAn Order of

Romania published Law No. 431 of 29 December 2023 in the Official Gazette on 5 January 2024, which provides for the implementation of the Romania published Law No. 431 of 29 December 2023 in the Official Gazette on 5 January 2024, which provides for the implementation of the Romania published

The OECD has published a taxation working paper on The Global Minimum Tax and the taxation of MNE profit. Among other things, the paper The OECD has published a taxation working paper on The Global Minimum Tax and the taxation of MNE profit. Among other things, the paper The OECD

| Abbreviation | Description |

|---|---|

| BEPS 2.0 | BEPS 2.0 |

| CbC - Country by Country reporting | CbC - Country by Country reporting |

| CbCr - Country by Country report | CbCr - Country by Country report |

| GILTI - Global Intangible Low-Taxed Income | GILTI - Global Intangible Low-Taxed Income |

| GIR - GloBE Information Return | GIR - GloBE Information Return |

| GloBE - Global Anti-Base Erosion | GloBE - Global Anti-Base Erosion |

| GMT - Global Minimum Tax | GMT - Global Minimum Tax |

| IFRS - International Financial Reporting Standards | IFRS - International Financial Reporting Standards |

| IIR - Income Inclusion Rule | IIR - Income Inclusion Rule |

| MNE - Multinational Enterprise or MNC - Multinational Corporation | MNE - Multinational Enterprise or MNC - Multinational Corporation |

| OECD - Organisation for Economic Co-operation and Development | OECD - Organisation for Economic Co-operation and Development |

| OTP - ONESOURCE Tax Provision | OTP - ONESOURCE Tax Provision |

| Pillar Two (or Pillar 2) | Pillar Two (or Pillar 2) |

| QDMT - Qualified Domestic Top-up Tax | QDMT - Qualified Domestic Top-up Tax |

| STTR - Subject to Tax Rule | STTR - Subject to Tax Rule |

| Subpart F | Subpart F |

| US GAAP - Generally Accepted Accounting Principles | US GAAP - Generally Accepted Accounting Principles |

| UTPR - Undertaxed Profits Rule | UTPR - Undertaxed Profits Rule |